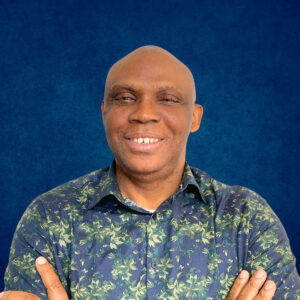

Vonda Henry

Vonda Henry

Advisor Information:

Educational Background:

B.S. in Accounting, Binghamton University, Binghamton, NY

M.S. in Accounting, Binghamton University, Binghamton, NY

Certified Public Accountant (CPA), Georgia State Board of Accountancy

Certified Public Accountant (CPA), Maryland Board of Public Accountancy

Certified Tax Planner (CTP)

Years of Experience: 20+

Professional Profile:

Short bio: Vonda Henry, born in Brooklyn and of Cuban and Jamaican descent, spent her early childhood in Jamaica, West Indies. She earned both a bachelor’s and master’s degree in Accounting from Binghamton University, a State University of New York, renowned for its rigorous academic programs and AACSB accreditation, placing it among the top business schools worldwide. Throughout her career, she has contributed to audits for prestigious companies like Christian Dior and Smith & Wesson and held financial roles at Computer Sciences Corporation and Marriott Corporation. Now at the helm of her own accounting firm, Vonda and her skilled team offer monthly accounting services, custom tax strategies, and representation for clients facing complex IRS issues. She is a proud member of the Georgia Society of CPAs, the American Society of Tax Problem Solvers, and a Certified Tax Planner. Vonda also serves as Vice President of Finance for the West End Merchant’s Coalition and offers tax expertise through Midas IQ. In her spare time, she enjoys reading, traveling, walking, and caring for her three rescue animals while making cherished memories with her large, extended family.

Strengths:

- 20+ Years of Experience

- Deep Tax Law Knowledge

- Tax Planning/Tax Resolution

- Client Commitment/Integrity

- Proactive Problem Solver

Favorite Kind of Clients and Entrepreneurs to Work With:

- Vonda loves to work with businesses that are young or in the mid-cycle of their business and are passionate about their business.

Preferred Communication Style:

- Vonda prefers to communicate through a secure portal and with videos. She finds videos convey complex issues much better than emails. Videos also allow her clients to review any complex ideas as many times as they need. Of course, her clients can always schedule an appointment. She encourages her clients to meet with her once a quarter.

Areas of Expertise:

Expertise/Specialty:

- Tax Research

- Small to medium businesses

Years Working with TFW Advisors:

Personal Insights:

Why I Love Being a CPA for Entrepreneurs:

- Being a CPA for entrepreneurs is exhilarating because the tax world for business owners is like an ever-evolving puzzle—no two are alike. Unlike the static tax laws for individuals, where options are limited, the tax laws for entrepreneurs are dynamic and filled with opportunities. It’s not about one-size-fits-all solutions; it’s about uncovering hidden pathways that can completely transform their financial outcomes.

- I love diving deep into the nuances of their business, figuring out how a simple change in entity structure or a strategic financial shift can unlock thousands of dollars in tax savings. The best part? Watching their faces light up when they realize they’re not just following the rules but using them to their advantage.

- I believe in empowering my clients by showing them that tax strategies are not just compliance tools—they are powerful business levers that can drive growth and success. Whether it’s saving money through innovative planning or making sure they’re prepared to win in an audit, I see myself not just as their CPA, but as their trusted partner in the journey toward long-term success.

Vonda Henry

Vonda Henry

Greg Clouse

Greg Clouse Bryan L. Ramirez

Bryan L. Ramirez Shelita Hall

Shelita Hall Maria Callahan

Maria Callahan

Andrew Ziolo

Andrew Ziolo